A View Of How Things Could Be Worse

Today is Tax Day. To paraphrase James Brown, time to give up and turn it loose.

Deductions and income, that is.

Nobody likes paying taxes, but it's one of those necessary evils to cover the essential services this country needs to function - even when it seems like nothing's being done.

In a way, we here in the United States have it pretty easy. According to an article I read this morning on the MSN Money website, the tax burden for an American single wage earner with two children is the third lowest in the world - only 29.1% of wages. Only Iceland (at 29%) and Ireland (at 25.7%) have lower tax burdens. Our Irish comrades have it even better if they are married with two children - only 8.1% of their income goes to paying taxes.

On the other end of the scale, if you're single with two children in Belgium, you're giving up a lot of chocolate coins with your 55.4% income tax base. A Swedish citizen in a similar tax bracket pays about a hair under half of his income (47.9%) in taxes, and a single parent in Hungary could end up going hungry paying her 50.9% tax bill.

They do get what they pay for, however, because the extra levies help pay for little goodies like secured pensions and lifetime socialized medicine. Not a bad trade off when you think about it.

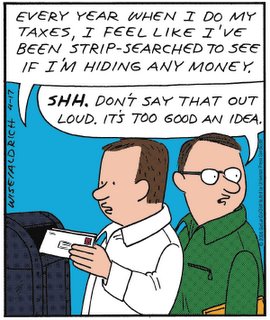

The article went on to say that while we Americans aren't too unhappy with the amount we pay, we are very unhappy with the rules that determine how much we pay. The United States has one of the most complicated set of tax laws in the world. The article didn't note if there was a country with a more complicated system. I wouldn't want to go digging that sort of information up, either. Might give our government some ideas for making a bad situation even worse.

The article did point out that state laws and levies help make a murky tax system even murkier, pointing out some rather unique laws currently on the books. Imagine going to H&R Block and reminding your tax specialist to include the following on your 1040:

- In Tennessee, you are required to pay a tax on the toke, snort, or shoot of your choice. All illegal drugs must be reported to the state within 48 hours of purchase and a tax must be paid. When your payment is received, you will receive a stamp to place on your substance as proof of payment. You can pay this tax anonymously, by the way, so you don't have to worry about breaking any other laws.

- In Chesapeake Bay, Maryland, a "flush tax" is levied to help with municipal clean-up efforts. You don't have to pay at the porcelain, however. The tax is added to septic and sewer bills.

- In Arkansas, you have to pay a tax for every tattoo or nose ring you receive in the state. Not sure if this tax applies to a Prince Albert, though.

- Since we're on the subject, if you appear completely or partially nude as part of your business in Utah, reach into that G-string and pay up a 10% "sexually explicit business" tax.

Funny all the ways one has to pay to play, isn't it? Now stop procrastinating and go pay your taxes.

More to come later.

0 Comments:

Post a Comment

<< Home